We use cookies to help provide you with the best possible online experience.

By using this site, you agree that we may store and access cookies on your device. Cookie policy.

Cookie settings.

Functional Cookies

Functional Cookies are enabled by default at all times so that we can save your preferences for cookie settings and ensure site works and delivers best experience.

3rd Party Cookies

This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages.

Keeping this cookie enabled helps us to improve our website.

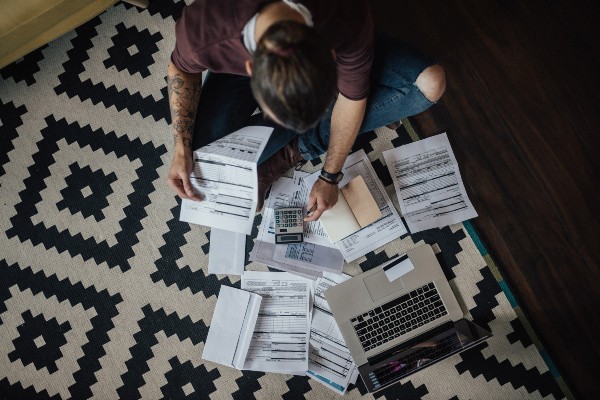

Finance and Debt Management

Managing your finances

If you realise gambling is a problem for you, handing over your finances to a trusted person such as your partner, a close friend or family member is always an option. This means you can start to address your gambling problem, but remember that this is not a permanent solution.

Whether you’re still gambling or you’ve stopped, deep in debt or just spending more than you should, tackling your finances is going to improve your life and help you regain some control.

Know how much you really spend

Make a list of your income and expenditure. You could use telephone or internet banking and check your balance weekly or even every day, or get a statement of your last few transactions.

Set a budget

Planning exactly how much you have to spend on your bills, food, travel and other necessities will help you work out how much you have left. Planning to save towards a treat for yourself when your savings reach a certain amount, or when you have not gambled for a certain length of time, can help strengthen your resolve.

Also consider larger annual and one-off expenses like clothes, furniture, home and garden maintenance and so on. Online tools to help with this are available from MoneyHelper.

Which banks currently let me block gambling transactions?

Refer to GamCare’s website for an up to date list.

Recovering from debt

Find out how much you owe

It may seem scary and you may not want to do it, but this is the first step to getting out of debt. Work out exactly how much you owe on each loan, card and overdraft and how far in arrears you are with household bills.

Prioritise your debts

Rent, mortgage, secured borrowing, council tax, income tax and VAT arrears take priority. If you don’t pay these you could have your fuel disconnected, lose your home or even go to prison.

Other debts such as unsecured loans, credit cards, overdrafts and student loans are not as high priority but there are still legal consequences of non-payment. These vary depending on whether you live in England, Wales or Scotland.

If you are not sure how to do this or are feeling overwhelmed, you might find it helpful to contact the National Debtline on 0808 808 4000, or read the advice on their website.

Seek specialist help

It’s particularly important to seek advice if you are a partner or otherwise financially linked to a problem gambler. You need to find out whether you are jointly liable for any of the debts or if only the gambler is liable.

Free, independent money advice is available from organisations including:

Some profit-making debt management companies also offer money advice and access to debt solutions, but be aware that there may be a fee if you then choose them to manage a debt solution for you. Make sure any charges are made clear in advance.

Are you entitled to benefits or tax credits?

Try a calculator to find out if there are any benefits or tax credits you could qualify for.

Start saving

Hopefully if you’ve stopped or cut down on gambling, and have started managing your money better, you’ll be able to start saving. It’s important to do your research. Picking an account that has a notice period such as a month or longer, may get you higher interest rates and act as an added deterrent if you are tempted to withdraw the money for gambling.

When you have started to recover financially

Some people find that finally having money in the bank is difficult, and the urge to gamble again is overwhelming. It can help to prepare in case you do start to feel like this. Plan a reward for yourself when you have saved a certain amount or gone a certain length of time without gambling.

It can help to have a source of support for when you feel compelled to gamble. Remember you can speak to GamCare via the National Gambling Helpline 24 hours a day on Freephone 0808 80 20 133 or via webchat on the Gamcare website.